ED having sleepless nights over failing economy

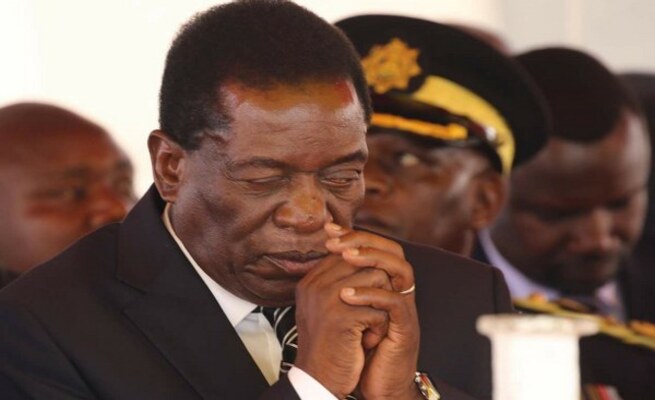

President Emmerson Mnangagwa

PRESIDENT Emmerson Mnangagwa is having sleepless nights over a failing economy characterised by a widening gap between the official and parallel market exchange rates, presidential spokesperson George Charamba said yesterday.

Mnangagwa met the Presidential Advisory Committee (Pac) yesterday amid rising discontent over the socio-economic situation in the country a week after the President claimed that trade unions calling for a salary hike were plotting his downfall.

Elsewhere, Reserve Bank of Zimbabwe governor John Mangudya admitted at a Zimbabwe Anti-Corruption Commission (Zacc) financial crime indaba held in Harare on Monday that Zimbabweans resent the local currency.

Mnangagwa re-introduced the local currency in 2019 after years of dollarisation, but hopes are fading that Mnangagwa would revive the economy as more Zimbabweans sink deeper into poverty.

Charamba said Mnangagwa and his advisers were concerned with the situation particularly the parallel market exchange rate and inflation.

“Like the President, Pac is concerned about the rising month-on-month inflation and the resurgence of exchange rates driven by the parallel market,” Charamba said.

“Both have a direct impact on the welfare threshold of the generality of the populace. Pac also noted with concern the growing threat of environmental degradation as uncontrolled mining encroaches onto agricultural land. Pac also expressed concern over certain environmental aspects which have negatively reshaped the business operating environment.”

Vice-President and Health minister Constantino Chiwenga attended the meeting.

Charamba said the meeting was meant to acquaint the government with the obtaining business situation as Mnangagwa’s administration sought to respond to the realities on the market.

Mnangagwa came into power amid promises to address the economic crisis, but the situation has worsened under his watch.

Zimbabwe is faced with a severe cash crisis and an inflationary environment while attempts to stop the “thriving” black market have failed.

Mangudya said Zimbabweans believed in dollarisation as the answer to the country’s socio-economic crisis.

“I do understand their behaviour because people lost value of their earnings in 2008 during the hyperinflation period. The vaccine that came to cure hyperinflation was, and is still dollarisation,” Mangudya said at the Zacc indaba.

“Now for Zimbabweans who went through the two episodes of hyperinflation and dollarisation, it means their mindset and their behaviour is now influenced by their past experiences.”

Later in an interview with NewsDay, the RBZ governor said he sympathised with civil servants who were queuing at banks for their United States dollar bonuses.

Mnangagwa and his loyalists have blamed the current economic crisis characterised the high unemployment on sanctions imposed by the US, the United Kingdom and the European Union.

But the West has maintained that the economic challenges in Zimbabwe are as a result of corruption and massive looting by those close to Mnangagwa’s government. Charamba said one of the issues that came out was “how to stabilise the operating environment to stop business from forward-pricing.”

“This is both a problem and a manifestation of a host of problems which underlie.”

Prices of basic commodities have been rising of late despite several companies reportedly benefiting from the weekly foreign currency auction system.

—News Day