Finance Minister to announce new measures to tackle worsening economic crisis

Mthuli Ncube Finance Minister

..last interventions reversed after a week

FINANCE Minister Professor Mthuli Ncube is this Monday expected to outline new government measures to tackle the worsening economic crisis with inflation topping 191% – among the highest in the world – while the Zimbabwe dollar has been sliding inexorably against the US green back.

Some of the measures under consideration include providing legal certainty around the continued use of the existing multi-currency regime.

Officials are concerned that the market is not assured that the “system is here to stay for the medium term”; as such a legally guaranteed period may be proposed.

Treasury is also keen to address the reluctance by exporters to release export receipts with huge amounts held in nostro accounts and not circulating in the economy.

A proposal has been mulled to legally ensure that exporters cannot permanently hold onto 70%-80% of their foreign exchange earnings.

Again, and to stop speculative borrowing, a member of the central bank’s monetary policy committee (MPC) revealed at the weekend that interest rates would be increased to levels in line with the rate of inflation.

“We have decided to bite the bullet,” the official told Bloomberg News. “Stability will be achieved through an aggressive monetary policy interest rate hike.”

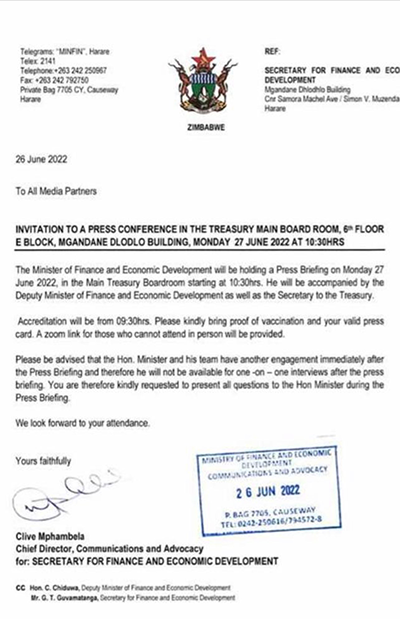

Treasury confirmed the press conference Sunday with Chief Director Communications and Advocacy Clive Mphambela in a statement saying it would be addressed by Prof Ncube with his deputy and ministry permanent secretary also in attendance.

This comes after President Emmerson Mnangagwa told the national conference of his ruling Zanu PF party that government would announce new measures to tackle inflation on Saturday.

Indicating that ruling party supporters are also getting restive over the increase in the cost of living, the Women’s League told Mnangagwa that “The increase in prices is quite shocking.”

Inflation which was at 96.4 percent in April, crept up to nearly 200 percent as prices of cooking oil and bread are leaping higher as a result of Russia’s invasion of Ukraine.

The Zimbabwean dollar has weakened 70% this year against the US dollar, making it Africa’s worst performing currency. The local unit officially trades at Z$355 per US dollar, but changes hands for between Z$500 and Z$670 on the parallel market, according to ZimPriceCheck.com, a website that tracks both the official and unofficial rates.

Nurses and doctors at state-run hospitals were on strike last week demanding a hefty raise and wages in US dollars due to the slide in the local currency and the erosion of the value of their earnings due to inflation.

However, the current economic challenges are not unique to Zimbabwe.

Many countries across the world are struggling with inflationary pressures and cost of living crises blamed on Russia’s war in Ukraine and sanctions imposed by the West in response.

This past week alone saw protests countries such as in Pakistan, unionized workers in Belgium, railway workers in Britain, Indigenous people in Ecuador, hundreds of U.S. pilots and some European airline workers. Sri Lanka’s prime minister declared an economic collapse Wednesday after weeks of political turmoil.

Economists say Russia’s war in Ukraine amplified inflation by further pushing up the cost of energy and prices of fertilizer, grains and cooking oils as farmers struggle to grow and export crops in one of the world’s key agricultural regions.

For Zimbabwe however, an already weak economy and endogenous peculiarities have the government ill-prepared to provide mitigate the impact of the global economic challenges.

The Mnangagwa administration blames market indiscipline and also suspects political machinations aimed at toppling the Zanu PF government.

In May the Zanu PF leader announced a raft of measures which aimed at tackling the inflationary pressures and included banning bank lending to government and the private sector.

The measures were rolled back barely a week later after it was realised that they were only worsening the crisis.

–New Zimbabwe