Finance Minister Mthuli Ncube delivers ‘stingy’ Mid Term Review; promotes widespread ZiG usage”

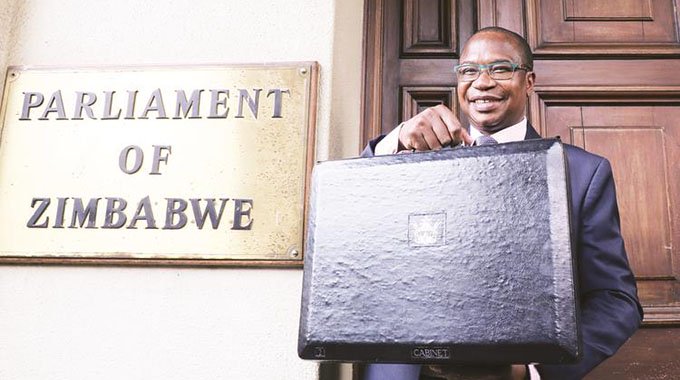

Minister Mthuli Ncube

FINANCE Minister Mthuli Ncube Thursday delivered a ‘stingy’ 2024 Mid Term Budget Review Statement, ignoring widespread calls to inject additional resources into critical departments while promoting the widespread usage of the ZiG currency.

Premised under the theme “Consolidating Economic Transformation” the Treasury chief rebased the initially approved expenditure for the 2024 Budget of ZW$58,2 trillion to a total envelope of ZiG87,9 billion.

He revealed that in the first six months of the year, total expenditure exceeded earnings by ZiG2, 4 billion after spending ZiG 38,9 billion from total revenue collections amounting to ZiG36,5 billion.

Despite initial calls by stakeholders in the run-up towards the Budget Review for Treasury to allocate additional resources towards the Welfare-related ministries like Health, Education, and Public Service, Ncube maintained a tight grip with no additional resources being allocated.

The developments signal very tough times for the drought-ravaged nation which has also seen a recent Zimbabwe Livelihoods Assessment Committee (ZimLAC) 2024 report revealing that nationally, 22.3% of school-aged children are not attending school due to financial difficulties, early marriages, and pregnancies.

Ncube pinned his hopes on the stability brought about by the recently introduced ZiG currency.

“Revenue projections to year end stand at ZiG93,221 billion (22% of GDP), against expenditures of ZiG96,8 billion and a resultant deficit of ZiG5,6 billion

“Since the introduction of the ZiG currency, the economy is experiencing relatively stable prices and exchange rates. In this regard, the fiscal policy thrust is sustaining the prevailing stable environment necessary for inclusive economic growth to achieve the objectives of the NDS 1 and Vision 2030,” he said.

In a bid to spur the widespread acceptance of the local currency, the Treasury boss moved to propose the amendment of 50:50 Tax payment legislation.

He said where a company’s revenue exceeds 50% in local currency, tax shall be payable proportionately in the currency of trade thereof.

“To promote the circulation of the ZiG within banking channels, curtail practices of money laundering, thereby combating financing of terrorism, I propose payment of all Presumptive Taxes in local currency, regardless of currency of trade,” said Ncube.

The payment of customs duty going forward will now be payable in local currency on selected products.